Based on the ICT analysis and research conducted by CEED Consulting, we can conclude that the ICT sector is one of the fastest-growing, at least in the context of Montenegro. This is evident from the rapid increase in the number of companies involved in this activity, their impressive financial revenues, and the growing interest of people in our community in this field.

ICT Cortex, a cluster with a primary focus on education, internationalization, and digital transformation, has analyzed the business performance of the Montenegrin ICT sector. The criteria for ranking success were total revenues, net results, the number of employees, and the number of companies.

An important contribution to the analysis was made by the research conducted by the consulting company CEED Consulting. Additionally, BI Consulting, with its portal BInfo.me, was a significant source of data on specific industry codes.

ICT Sector in Montenegro

This analysis covered 1,049 companies that were part of the Montenegrin ICT sector in 2022 alone. However, to make the analysis comprehensive, the period from 2019 to 2022 was considered, tracking the trends of growth or decline in the three specific groupings of the ICT sector: IT services and products, telecommunications, and trade of IT equipment.

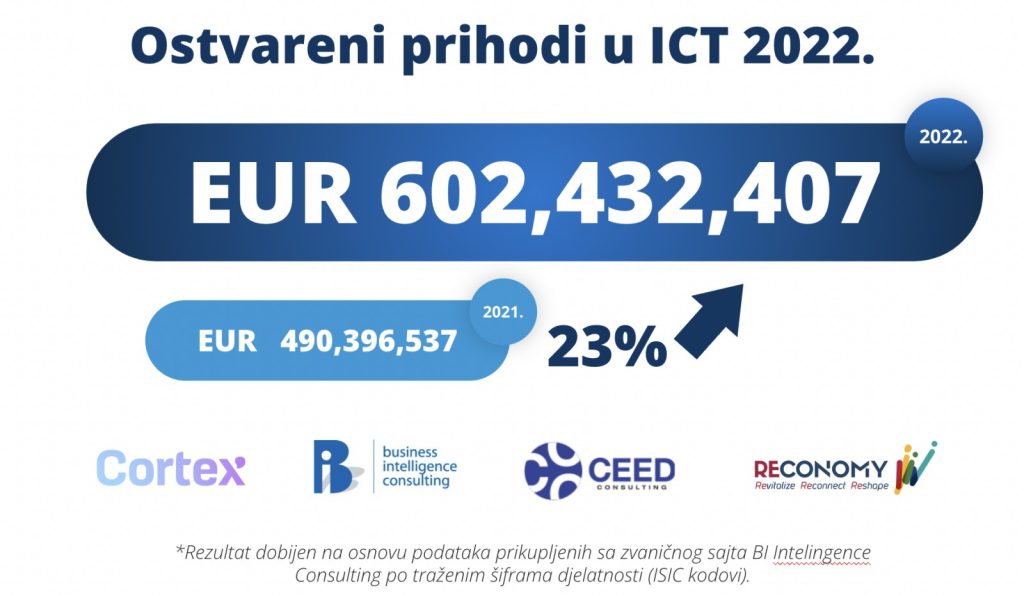

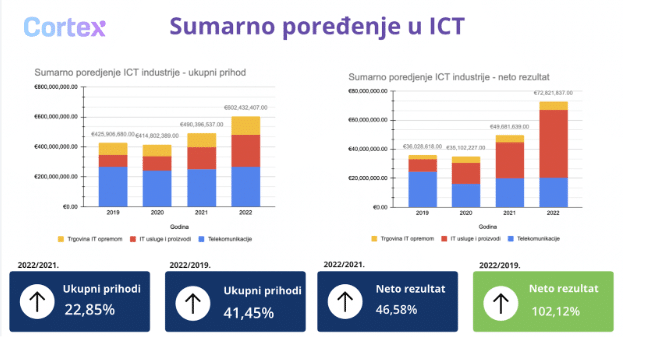

Regarding the revenues generated in the ICT field during the previous year, the figures were more than impressive. The total revenue for the ICT sector in 2022 amounted to as much as 602 million euros, which is 23 percent higher than in 2021. The majority of the revenue comes from the telecommunications sector, followed by IT services and products, and trade of IT equipment. Net earnings have also significantly increased over the past four years, with a growth rate of 102 percent compared to 2019.

Some of the companies that particularly stood out in terms of revenue in the previous period and made significant contributions to the revenue growth in the Montenegrin ICT sector are M-tel, Crnogorski Telekom, One, Kodio, Comtrade, and Coinis.

Below, you can see the individual contributions of each of the mentioned areas to the information and communication technology sector.

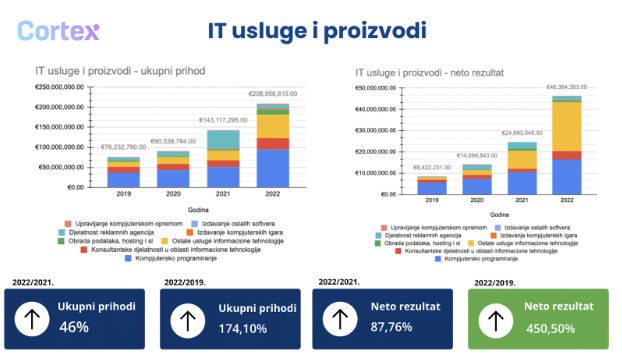

IT Services and Products

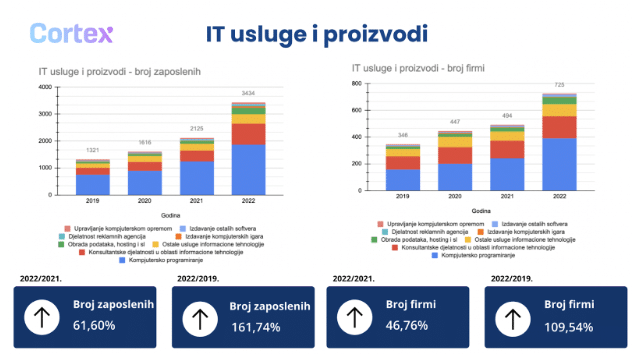

Regarding the IT sector, we analyzed 725 companies actively operating in the local and international markets. The largest number of these companies are engaged in computer programming and consulting activities in the field of information technology, while specialized areas such as computer game development and software publishing are represented in a smaller number. It is worth noting that this field has seen a significant increase in the number of companies, with a growth rate of 46 percent compared to 2021 and a remarkable 109 percent compared to 2019.

Companies in the IT services and products sector have made the most progress in the past four years when considering parameters such as total revenue, net results, and the number of employees. Total revenues increased by 45 percent compared to 2021, net results increased by 87 percent, and compared to 2019, the same parameter increased by an impressive 450 percent.

The number of employees adequately follows the revenue growth, as indicated by the fact that over 3,400 workers have been employed in the IT products and services sector, which is 61 percent more than the previous year and a remarkable 161 percent increase compared to four years ago. When looking at the specific specialization, the largest number of companies are engaged in computer programming and IT consulting activities. Some of the companies that achieved the best results are Epam Systems Montenegro, Domen, Data Design, Čikom, and Logate.

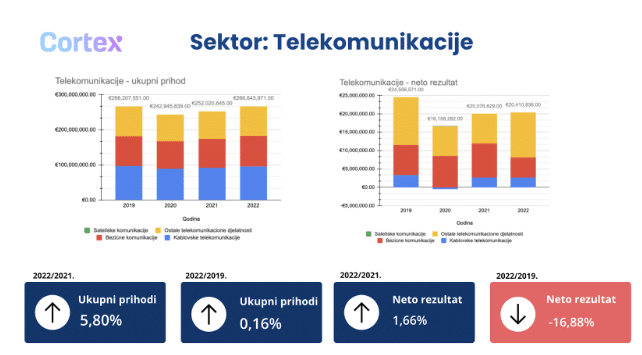

Telecommunications

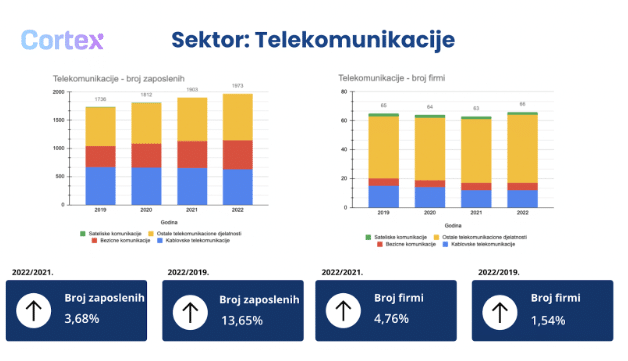

In the field of telecommunications, we analyzed 66 companies operating in our market. Over 60 percent of them are registered under the activity code “other telecommunications activities,” while a smaller number are involved in satellite and wireless communications, as well as cable telecommunications. Here, we have a slightly different picture compared to the IT sector. The growth rate of the number of companies over the past four years is only 1.5 percent, indicating that the telecommunications sector is relatively stable, with few changes in the number of firms in the previous period, averaging 64.

Companies in the telecommunications sector have traditionally continued to generate impressive revenues. However, these revenues do not show significant fluctuations like those observed in the IT sector. The total revenue of Montenegrin companies engaged in telecommunications activities amounted to 266 million euros, which is nearly six percent higher than in 2019.

Net results also did not experience significant growth, with an increase of less than 2 percent compared to 2021 and a decrease of nearly 17 percent compared to four years ago, indicating that the overall profit in this sector was significantly higher in 2019 than it is today. The three traditional telecommunications providers operating in our market, namely M-tel, Crnogorski Telekom, and ONE, achieved the best results in this field. Significant results were also achieved by companies such as Telemach, Ericsson AB, the Agency for Electronic Communications and Postal Services, and Network Communication.

The total number of employees in this sector is 1,973, with as much as 65 percent of them employed in the three leading companies in the telecommunications sector (M-tel, Crnogorski Telekom, and ONE). This number is nearly 14 percent higher than in 2019.

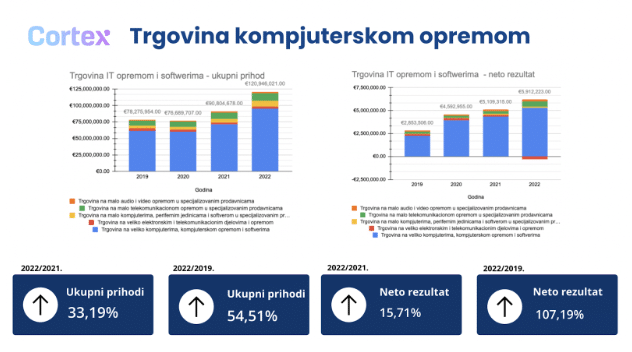

Trade of Computer Equipment

Regarding the sector related to the trade of computer equipment, it should be highlighted that the total revenue in 2022 amounted to nearly 121 million euros, which is 33 percent higher than the previous year. Compared to 2019, this represents a 54 percent increase, while net profit for the same period has increased by 107 percent, reaching almost 6 million euros.

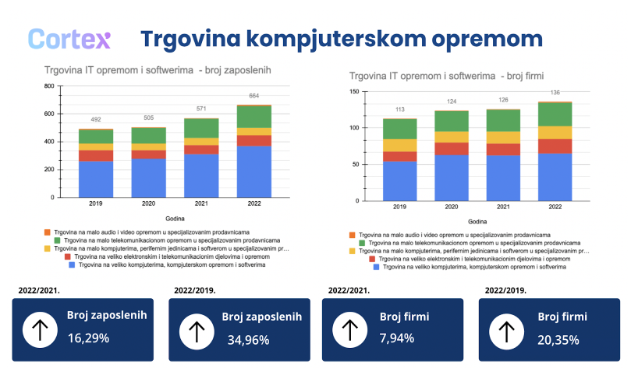

The majority of companies in this field are primarily engaged in the wholesale trade of computers, computer equipment, and software, while a smaller number focus on the retail trade of telecommunications equipment, audio, and video equipment, as well as the wholesale trade of electronic and telecommunications parts. The number of employees in this sector increased by 16 percent in the previous year, reaching 664, which is a significant advancement, especially when comparing it to the number of employees in 2019, which stood at 492. Some of the companies in this sector that achieved significant results in the previous period include Comtrade, KimTec, and EWE Montenegro.

Information and Communication Technologies in the Past Ten Years

The progress of the information technology (IT) sector in Montenegro is best observed by examining its chronological development. At the beginning of the previous decade, in 2012, the total revenue of the ICT sector exceeded 124 million euros, accounting for nearly four percent of the country’s GDP at that time. Today, the contribution of this sector to the Montenegrin economy is significantly higher. The total revenue of the ICT sector in 2022 amounted to 602 million euros, reaching ten percent of the total GDP according to the previously mentioned data and parameters. Based on the analysis, we can conclude that the share of information technology in the national gross domestic product has increased by just over six percent in the last ten years, further demonstrating the constant development and growing importance of the ICT sector in the Montenegrin economy.

The advantages of IT compared to these three industries are reflected in its exponential growth, which has been consistently observed, especially in the past four years. The ICT industry employs over 6,000 people, with nearly 3,500 working in the IT domain. It is evident that this is one of the most promising economic sectors in Montenegro, and we are yet to see its full potential in the coming years.

“Positive trends in the ICT sector in Montenegro have continued in 2022. The financial reports for the year confirm a constant increase in the number of companies, their revenues, and the number of employees, particularly in the area of IT services and products. In addition to the local players, this growth has been contributed to by foreign companies, indicating that Montenegro is recognized as a favorable destination for the development of this industry. Considering this, it would be important to reciprocate the expressed confidence and continue working on a business environment that provides reasons for foreign companies to stay while also supporting domestic IT companies and those yet to emerge, as they are expected to drive the process of digital transformation that lies ahead,” stated Ratko Nikolić, founder of Bi Consulting, a member of the ICT cluster Cortex.

Rapid growth, export potential, and investment opportunities

Based on ICT analysis and research conducted by CEED Consulting, it can be concluded that the ICT sector is one of the fastest-growing, at least in Montenegro. This is evident from the significant increase in the number of companies operating in this field, their substantial financial revenues, and the increasing interest of people in our community in this sector, as reflected in the significant rise in the number of employees.

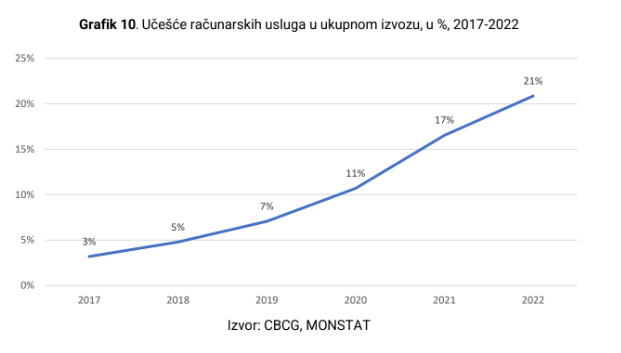

Research conducted by the Central Bank of Montenegro and MONSTAT also confirms the export potential of the Montenegrin ICT sector. According to their findings, the export activities of computer services have seen a growing share in the country’s total exports, increasing from seven percent to as high as 21 percent in the past four years.

Furthermore, an important aspect to highlight is the large number of newly established companies, whose results will be visible in the upcoming years and are likely to play a significant role in the Montenegrin ICT sector.

In conclusion, the ICT industry, especially the area focused on information technology, has made significant progress in the past four years, as evidenced by the research findings. With such results, Montenegro has become an important country for investments in the field of information technology and an attractive destination for digital nomads. For these reasons, the ICT sector undoubtedly deserves special attention from governmental institutions and the non-governmental sector. Based on the obtained results, we can anticipate that the information and communication technology sector will continue to grow and has the potential to become a strategic branch in the development of the Montenegrin economy.

Author: Stefan Blecic